what are federal back taxes

Filing back tax returns could help you do one or more of the following. Assemble all of your tax documents - your W-2s 1099s and other tax.

Tax Debt Here S How To Handle Outstanding Federal Obligations

Viewing your IRS account information.

. Many of them you can do by yourself. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Biden tax plan could raise middle class taxes slightly.

If you cant find the answers to your tax questions on IRSgov we can offer you help in more than 350 languages with the support of professional. Here are the key differences. 1 day agoChurches are breaking the law and endorsing in elections experts say.

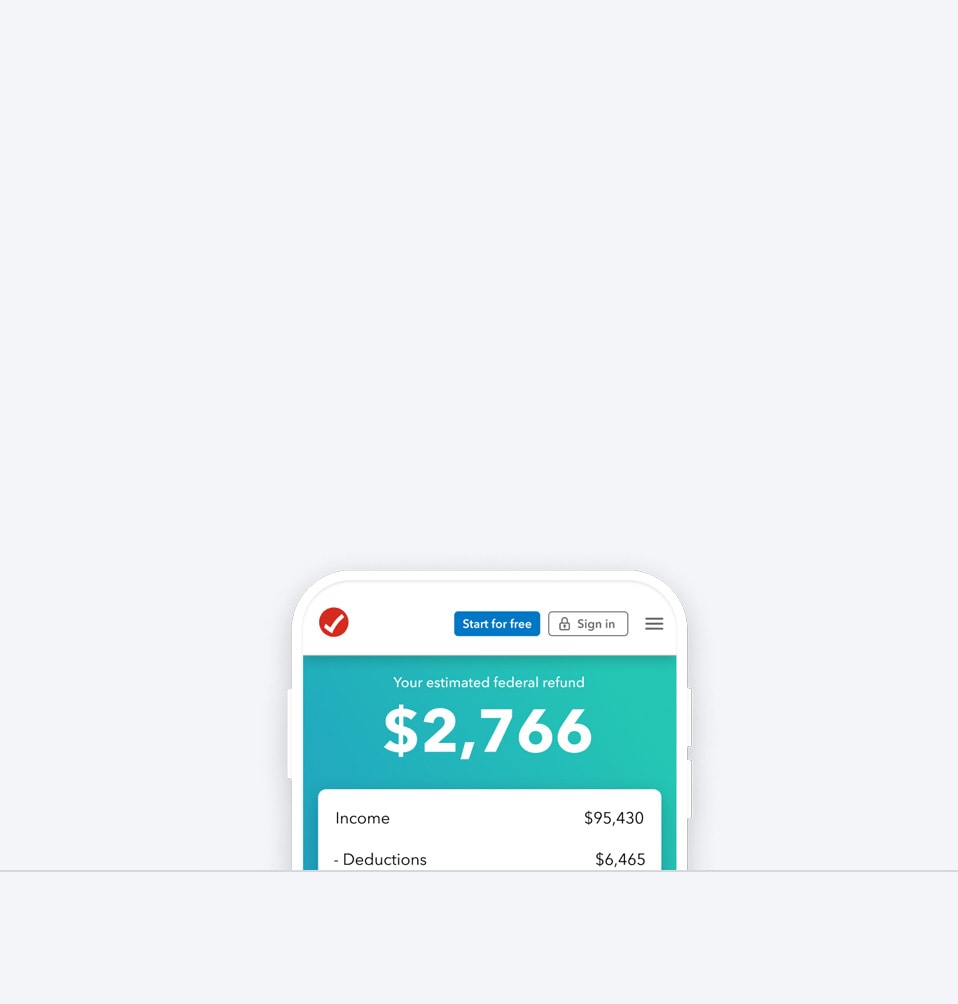

7 hours agoHowever the lucky ticket holder wont be bringing home the full 1 billion worth of bacon after state and federal taxes take away a chunk of the sum. The IRS looks the other way. 2022-2023 Tax Brackets and Federal Income Tax Rates.

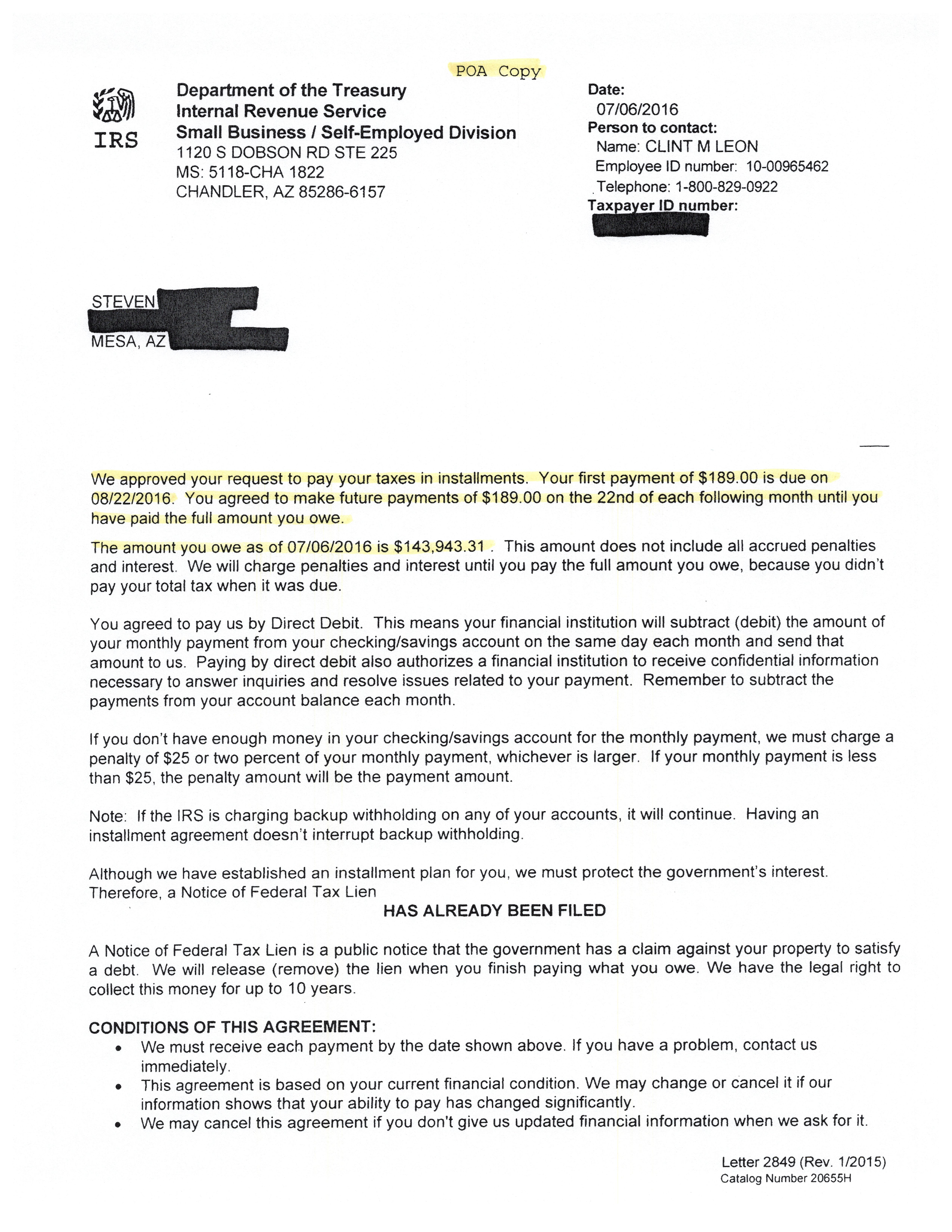

Back taxes refer to an outstanding federal or state tax liability from a prior year. If you owe back taxes here are four options that could help you find some tax relief. It takes about six weeks for the IRS to process accurately completed back tax returns.

In 2022 Social Security payroll taxes. Households will pay no federal income taxes this year. Using the IRS Wheres My Refund tool.

If you need wage and income information to help prepare a past due return. Federal income tax returns are typically due each year on April 15 for the prior year. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD.

Some 725 million households or 40 of households will pay no federal income tax this year down from the pre-pandemic high of 60 two years ago according to new estimates. Sometimes tax relief is denied simply because of the lack of representation. Why you should file back taxes.

Federal income tax rates range from 10 to 37 and kick in at specific income thresholds. The income ranges the rates apply to are called tax brackets. You can also call the IRS at 1-800-829-1040 or TTY.

One practical reason to file a back tax return is to see. In order to secure your tax refund when you owe federal back taxes your first step is to file your federal tax return. For the fastest information the IRS recommends finding answers to your tax questions online.

Remember you can file back taxes with the IRS at any time but if you want to claim. They have years dating back to 2002 available although only 2021 can be efiled. If you have tax problems call as soon as possible so you can protect your assets and bring your account back.

3 hours agoFor example if you purchased a Ford F-150 Lightning and owed say 3500 in income tax this year then that is the federal tax credit you would receive. For nearly 70 years federal law has barred churches from directly involving. The two years that will have to be mailed.

12 hours ago725 million US. The Social Security 2100 bill calls for enhancing the benefits and paying for it by reapplying the payroll tax on wages of 400000 and up. If you owed 10000.

It is free for federal and around 1995 if you file a state return. Exactly how much will. Help Filing Your Past Due Return.

How Social Security Garnishment Works With Federal Back Taxes

Connecticut Tax Resolution Options For Back Taxes Owed

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

Press Releases Scam Targeting Back Taxes Sheriff S Office Jefferson County Tx

9 Takeaways On Businesses With Back Taxes Getting Federal Aid 9news Com

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

Do I Need To File Back Taxes In Mesa Az Tax Debt Advisors

Irs Says Ja Rule Owes 2m In Federal Back Taxes Hiphopdx

Fbi Federal Bureau Of Investigation Know The Facts And Protect Yourself From Scams This Tax Season The Irs Will Never Ask You For Debit Credit Card Numbers Over The Phone Demand

How Do Federal Income Tax Rates Work Tax Policy Center

Slash Irs Back Taxes Negotiate Irs Back Taxes For As Little As Ten Cents On 9781938148095 Ebay

:max_bytes(150000):strip_icc()/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)

Tax Refund Missing Reasons You Never Received One

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Federal Vape Tax Reappears In Build Back Better New Cigarette Tax Vanishes

Best Way To Pay Your Back Taxes And Get Relief Forbes Advisor Forbes Advisor

Will The Irs Take My House For Owing Back Taxes

Owe Back Taxes The Irs May Grant You Uncollectible Status Grady H Williams Jr Ll M Attorneys At Law