45l tax credit requirements

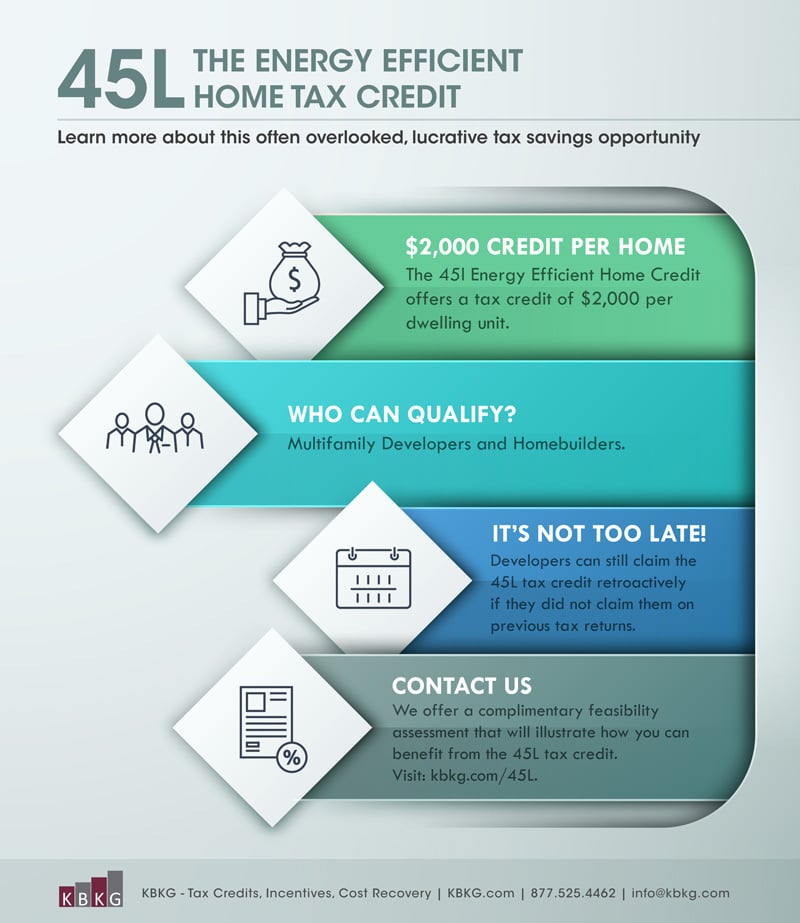

The version of the 45L Tax Credit that our industry has leveraged for over 15 years expired on December 31 2021 meaning that there is no active 45L Tax Credit for homes built. The energy-efficient home credit provides developers a tax credit of up to 2000 per qualifying unit if they can certify the energy-saving qualities of the residence.

How Does The 45l Tax Credit Work Energy Diagnostic

The deduction amount is determined based on your taxable income filing status and the.

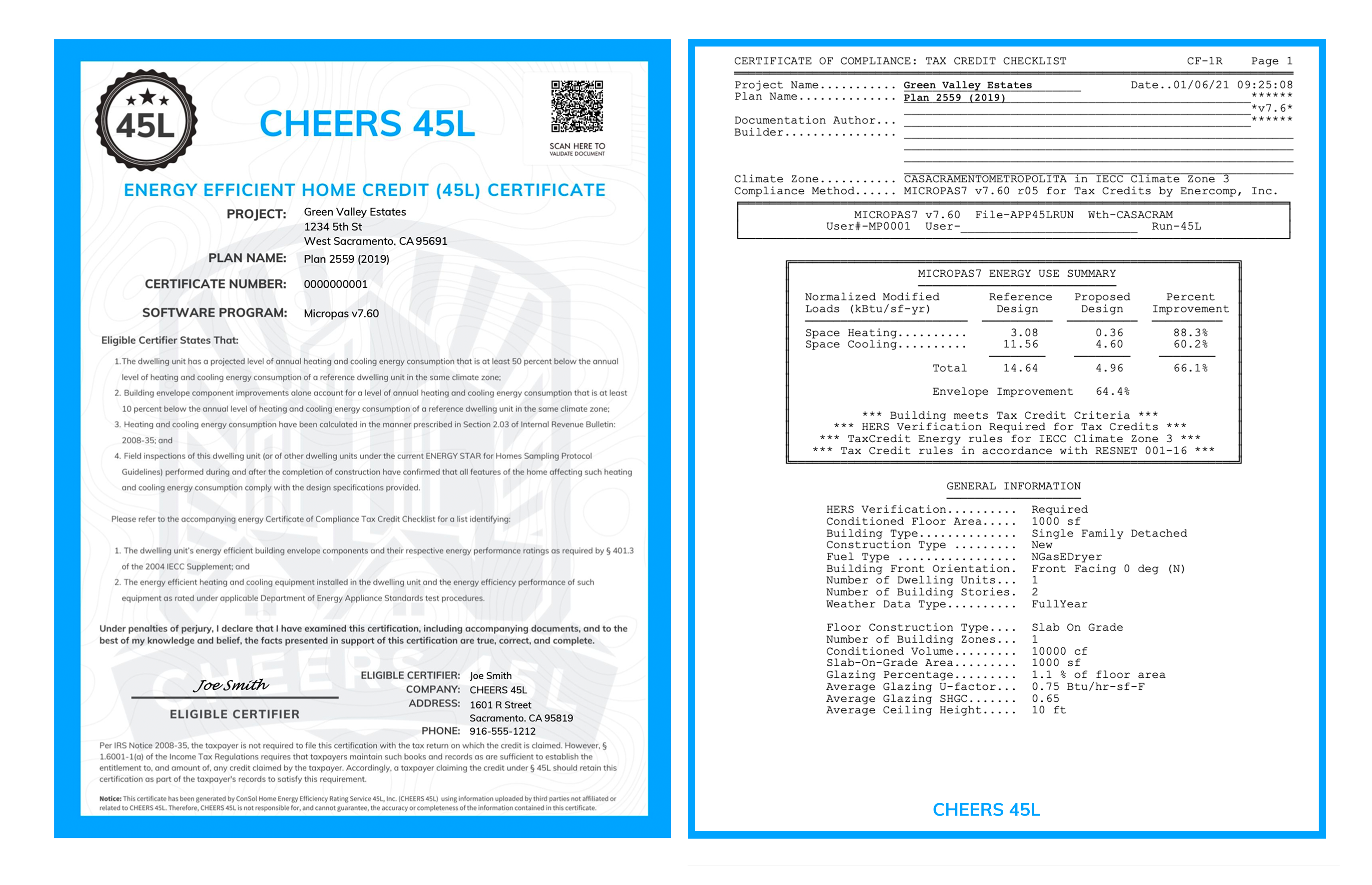

. Claiming the Tax Credit. Code 45L - New energy efficient home credit. The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home.

Purposes of obtaining a certification that satisfies the requirements of 45Ld. Incentives depend on the HERS score and the classification. Originally expired at the end of 2021 45L tax credits have been retroactively extended under the same program through the end of 2022.

After the detailed energy study has been certified and documented IRS Form 8908 is to be filed by the developer during the service year to claim the tax credit. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854.

NJ Clean Energy- Residential New Construction Program. In late 2019 the tax credit was. The deduction will reduce the taxable income used to calculate your tax.

The good news is that you can go back and claim the 45L credit for properties that have been built or remodeled in the past three years. 2000 per qualified home Single family and multi-family projects up to. The 45L Credit which currently only applies to homes leased or sold prior to January 1 2022 provides a 2000 dollar per home tax credit for homes that meet certain energy efficiency.

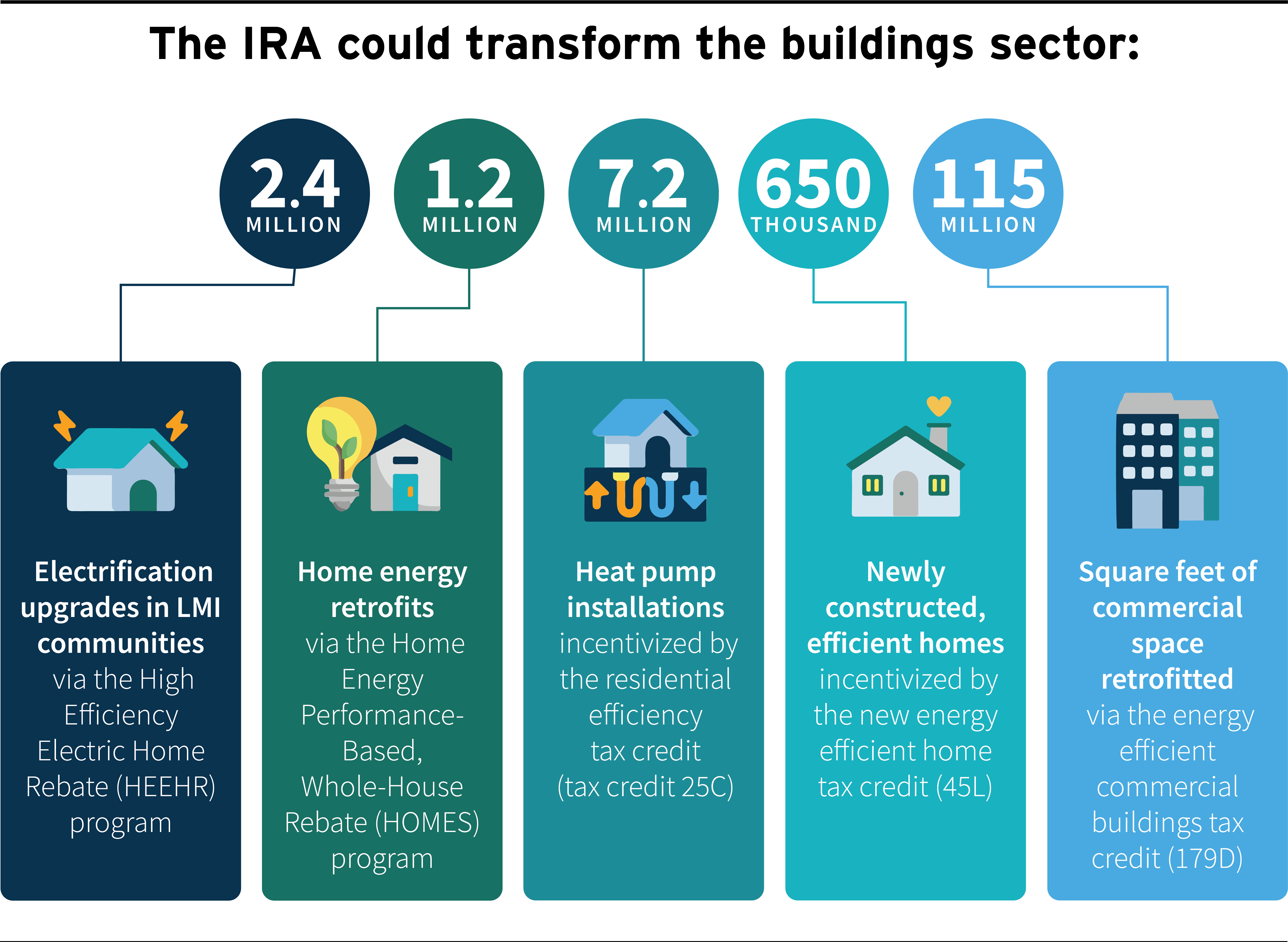

The requirements described in this subparagraph with respect to any. The new energy efficient home credit as defined by Internal Revenue Code IRC Section 45L was extended increased and modified under the Inflation Reduction Act of 2022. Browse reviews directions phone numbers and more info on Tax Credits LLC.

Guidance relating to manufactured homes will be provided in a separate notice. Quick search by citation. You are eligible for a property tax deduction or a property tax credit only if.

Starting in 2023 and extending.

El Camino Real Apartments Earns Leed For Homes Platinum Certification Green Insight Green Building Consultants

45l Tax Credit Energy Efficient Tax Credit 45l

Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives Capstan Tax Strategies

The Inflation Reduction Act Extending Expanding 179d And 45l

Ira Seeks To Transform The Building Sector

Contractors Securing Work With The 45l Tax Credit Aeroseal

45l Tax Credit What Is The 45l Tax Credit Who Qualifies

45l Federal Builder Tax Credit

One Year Extension Through 2021 For Energy Efficient Home Section 45l Tax Credit Warner Robinson Llc

Everything You Need To Know About 45l Tax Credit Mom And More

Inflation Reduction Act Expands Energy Efficiency Tax Incentives

45l Energy Efficient Home Credit Ics Inspectors Llc

Section 45l Energy Tax Credit Past Present And Future Ekotrope

45l Tax Credit Services Using Doe Approved Software

New Energy Efficient Home Tax Credit 45l Fox Energy Specialists Texas Energy Code And Hers Rating Services